Blog: Insurance Claim Help

Why Experience Matters in Choosing a Public Insurance Adjuster in Florida

From Insurance Companies to Policyholders: A Journey of Expertise I used to be on the other side of the table, representing insurance companies as an insurance company adjuster. This experience has given me a unique perspective on how insurance companies operate, what they look for in claims, and how they try to minimize payouts. Now,…

How I Got My SW Florida Client’s Claim Paid Faster

Last week there was a insurance claim village in Port Charlotte, FL. I personally went to the insurance claim village with a box of my client files. I have clients in Sanibel Island, Punta Gorda, Cape Coral, and Port Charlotte. At the insurance claim village, I met with Heritage Insurance Company representative, Front Line Insurance…

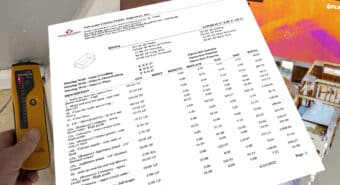

Details are Important for Insurance Claims

Documenting insurance claims is very important. Details matter! To properly document all the necessary details to prove the policy holder damages requires knowledge, experience, and the proper tools. Some of the tools needed to be able to record the property damages are as follows: Moisture Meter Thermal Camera Matterport Video Detailed Estimate Most homeowners and…

Why Millennials Should Not Trust Virtual Claim Adjusting

Millennials tend to be new first time home buyers. Never having experienced making an insurance claim for their new home. Recent insurance company polls suggest that millennials like the ease of texting and photographing their damages with their cell phone and getting their claim resolved using technology. Insurance carriers sometimes calls this process of claim…

Advanced 360 Technology Enhances Insurance Claim Documentation

Advocate Claims Public Adjusters a Florida Public Adjusting Company invests in the latest technology to better tell your insurance claim story. Our newest 360-degree camera allows us to take 360 photos of each room in your property. This gives us the ability to create an actual video presentation of walking thru your home, condominium or…

Traversing Insurance Settlement Checks with Your Mortgage Company: It’s No Easy Feat!

If you have a mortgage on your home or business, and you experience major damage or even a total loss, your settlement claim payment checks from your insurance provider will be made payable jointly to BOTH you and your mortgage company. The reason for this is because your mortgage lender has a financial interest in…

Filing a Homeowner’s Insurance Claim for Kitchen Damage

As a homeowner, it is important to know where issues primarily arise in a home so that you can take measures to avoid them. Public adjusters in Parkland, Florida know that most Florida homeowners are concerned about hurricane damage since it is relatively unpredictable each year. Along with hurricanes, Florida homeowners worry about flooding from…

What to Do When Your Homeowner’s Insurance Claim Is Denied

Imagine paying several hundred or even thousands of dollars on your homeowner’s insurance coverage, only to file a claim and have it denied or have the settlement delayed – leaving you with a dent in your bank account or having to obtain a loan in order to make the repairs in the meantime. According to…

Can the Insurance Company Treat Me Differently if I Hire a Public Adjuster?

When the unfortunate time comes to file a residential or commercial property insurance claim, a lot of individuals wonder if hiring a professional to help streamline the process will actually hinder them in the eyes of their insurance company. Luckily, this is not typically the case. In fact, that great saying “the squeaky wheel gets…

Why Does My Insurance Check Have the Mortgage Company Name on It?

After going through the entire process of filing a homeowner’s insurance claim with your South Florida public adjuster, you may notice that your insurance check has your mortgage company’s name on it, and be curious why. Although you may think you own your home, in reality, if you have a mortgage, the mortgage company has…